Credit Card Big Data Use Cases . as a data asset, the same can be applied to many downstream use cases, such as loyalty programs for online banking. in essence, credit card companies and other large entities are now, thanks to new analytics and big data, reducing the success rate of credit. detection and prevention of fraud. join our expert discussion to learn about cloud use cases and the innovative potential for ai in your business. Fraud detection and prevention are tremendously aided by machine learning, which is fuelled by large data. The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. use cases of big data in finance.

from data-flair.training

use cases of big data in finance. detection and prevention of fraud. Fraud detection and prevention are tremendously aided by machine learning, which is fuelled by large data. as a data asset, the same can be applied to many downstream use cases, such as loyalty programs for online banking. The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. in essence, credit card companies and other large entities are now, thanks to new analytics and big data, reducing the success rate of credit. join our expert discussion to learn about cloud use cases and the innovative potential for ai in your business.

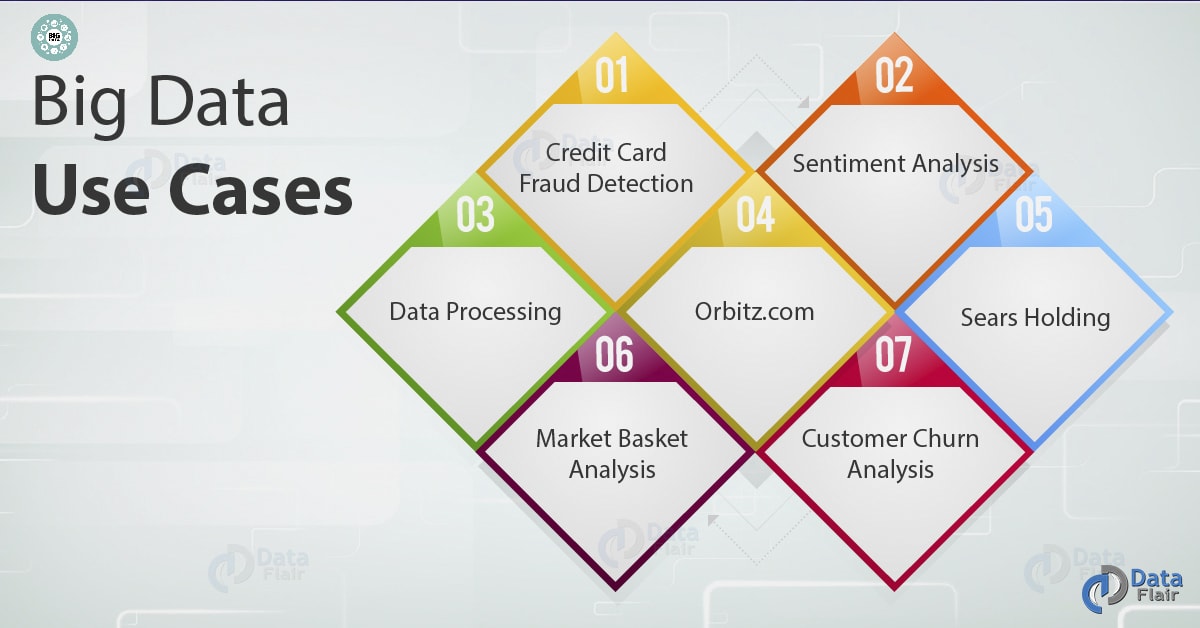

Big Data Use Cases Hadoop, Spark and Flink Case Studies DataFlair

Credit Card Big Data Use Cases as a data asset, the same can be applied to many downstream use cases, such as loyalty programs for online banking. use cases of big data in finance. join our expert discussion to learn about cloud use cases and the innovative potential for ai in your business. The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. Fraud detection and prevention are tremendously aided by machine learning, which is fuelled by large data. in essence, credit card companies and other large entities are now, thanks to new analytics and big data, reducing the success rate of credit. as a data asset, the same can be applied to many downstream use cases, such as loyalty programs for online banking. detection and prevention of fraud.

From mungfali.com

Use Case Diagram For Online Payment System Credit Card Big Data Use Cases join our expert discussion to learn about cloud use cases and the innovative potential for ai in your business. Fraud detection and prevention are tremendously aided by machine learning, which is fuelled by large data. as a data asset, the same can be applied to many downstream use cases, such as loyalty programs for online banking. in. Credit Card Big Data Use Cases.

From clarusway.com

What Is Big Data? What Makes It Important Clarusway Credit Card Big Data Use Cases in essence, credit card companies and other large entities are now, thanks to new analytics and big data, reducing the success rate of credit. join our expert discussion to learn about cloud use cases and the innovative potential for ai in your business. The application of big data analytics in the financial industry is diverse and dynamic, ranging. Credit Card Big Data Use Cases.

From www.researchgate.net

Big Data Use Cases Comparison Download Table Credit Card Big Data Use Cases The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. use cases of big data in finance. join our expert discussion to learn about cloud use cases and the innovative potential for ai in your business. as a data asset, the same can be applied to many downstream. Credit Card Big Data Use Cases.

From www.slideshare.net

SOME BIG DATA USE CASES Credit Card Big Data Use Cases in essence, credit card companies and other large entities are now, thanks to new analytics and big data, reducing the success rate of credit. Fraud detection and prevention are tremendously aided by machine learning, which is fuelled by large data. The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to.. Credit Card Big Data Use Cases.

From www.techtarget.com

8 Big Data Use Cases for Businesses and Industry Examples Credit Card Big Data Use Cases join our expert discussion to learn about cloud use cases and the innovative potential for ai in your business. The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. use cases of big data in finance. in essence, credit card companies and other large entities are now, thanks. Credit Card Big Data Use Cases.

From www.intuz.com

Top 14 use cases of big data you should know in 2022 Credit Card Big Data Use Cases The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. in essence, credit card companies and other large entities are now, thanks to new analytics and big data, reducing the success rate of credit. join our expert discussion to learn about cloud use cases and the innovative potential for. Credit Card Big Data Use Cases.

From hpc-asia.com

3 Big Data Use Cases Credit Card Big Data Use Cases Fraud detection and prevention are tremendously aided by machine learning, which is fuelled by large data. in essence, credit card companies and other large entities are now, thanks to new analytics and big data, reducing the success rate of credit. as a data asset, the same can be applied to many downstream use cases, such as loyalty programs. Credit Card Big Data Use Cases.

From nix-united.com

Big Data in Main Trends & Use Cases NIX United Credit Card Big Data Use Cases use cases of big data in finance. join our expert discussion to learn about cloud use cases and the innovative potential for ai in your business. as a data asset, the same can be applied to many downstream use cases, such as loyalty programs for online banking. detection and prevention of fraud. Fraud detection and prevention. Credit Card Big Data Use Cases.

From www.vrogue.co

Five Common Data Analytics Use Cases You Need To Know vrogue.co Credit Card Big Data Use Cases detection and prevention of fraud. The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. as a data asset, the same can be applied to many downstream use cases, such as loyalty programs for online banking. join our expert discussion to learn about cloud use cases and the. Credit Card Big Data Use Cases.

From svitla.com

Big Data for Banking Key Use Cases & Tools Credit Card Big Data Use Cases detection and prevention of fraud. in essence, credit card companies and other large entities are now, thanks to new analytics and big data, reducing the success rate of credit. join our expert discussion to learn about cloud use cases and the innovative potential for ai in your business. use cases of big data in finance. Fraud. Credit Card Big Data Use Cases.

From techvidvan.com

Top 10 Big Data Case Studies that You Should Know TechVidvan Credit Card Big Data Use Cases detection and prevention of fraud. as a data asset, the same can be applied to many downstream use cases, such as loyalty programs for online banking. The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. join our expert discussion to learn about cloud use cases and the. Credit Card Big Data Use Cases.

From mungfali.com

Credit Card Use Case Diagram Credit Card Big Data Use Cases The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. in essence, credit card companies and other large entities are now, thanks to new analytics and big data, reducing the success rate of credit. join our expert discussion to learn about cloud use cases and the innovative potential for. Credit Card Big Data Use Cases.

From blog.golayer.io

26 Big Data Use Cases and Examples for Business Layer Blog Credit Card Big Data Use Cases in essence, credit card companies and other large entities are now, thanks to new analytics and big data, reducing the success rate of credit. use cases of big data in finance. detection and prevention of fraud. Fraud detection and prevention are tremendously aided by machine learning, which is fuelled by large data. as a data asset,. Credit Card Big Data Use Cases.

From www.dw.com

Credit card cloning on rise in India amid Narendra Modi′s cashless push Credit Card Big Data Use Cases Fraud detection and prevention are tremendously aided by machine learning, which is fuelled by large data. The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. use cases of big data in finance. as a data asset, the same can be applied to many downstream use cases, such as. Credit Card Big Data Use Cases.

From www.projectpro.io

6 Big Data Use Cases How Companies Use Big Data? Credit Card Big Data Use Cases in essence, credit card companies and other large entities are now, thanks to new analytics and big data, reducing the success rate of credit. detection and prevention of fraud. The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. as a data asset, the same can be applied. Credit Card Big Data Use Cases.

From www.mdpi.com

Applied Sciences Free FullText Machine Learning Based on Credit Card Big Data Use Cases detection and prevention of fraud. as a data asset, the same can be applied to many downstream use cases, such as loyalty programs for online banking. Fraud detection and prevention are tremendously aided by machine learning, which is fuelled by large data. The application of big data analytics in the financial industry is diverse and dynamic, ranging from. Credit Card Big Data Use Cases.

From laptrinhx.com

What Is Big Data? LaptrinhX Credit Card Big Data Use Cases The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to. Fraud detection and prevention are tremendously aided by machine learning, which is fuelled by large data. join our expert discussion to learn about cloud use cases and the innovative potential for ai in your business. in essence, credit card. Credit Card Big Data Use Cases.

From mungfali.com

Credit Card Fraud Detection Use Case Diagram Credit Card Big Data Use Cases use cases of big data in finance. as a data asset, the same can be applied to many downstream use cases, such as loyalty programs for online banking. detection and prevention of fraud. join our expert discussion to learn about cloud use cases and the innovative potential for ai in your business. The application of big. Credit Card Big Data Use Cases.